The Etailed India story

Became an ATM & allow anybody to withdraw money through Biometrics.

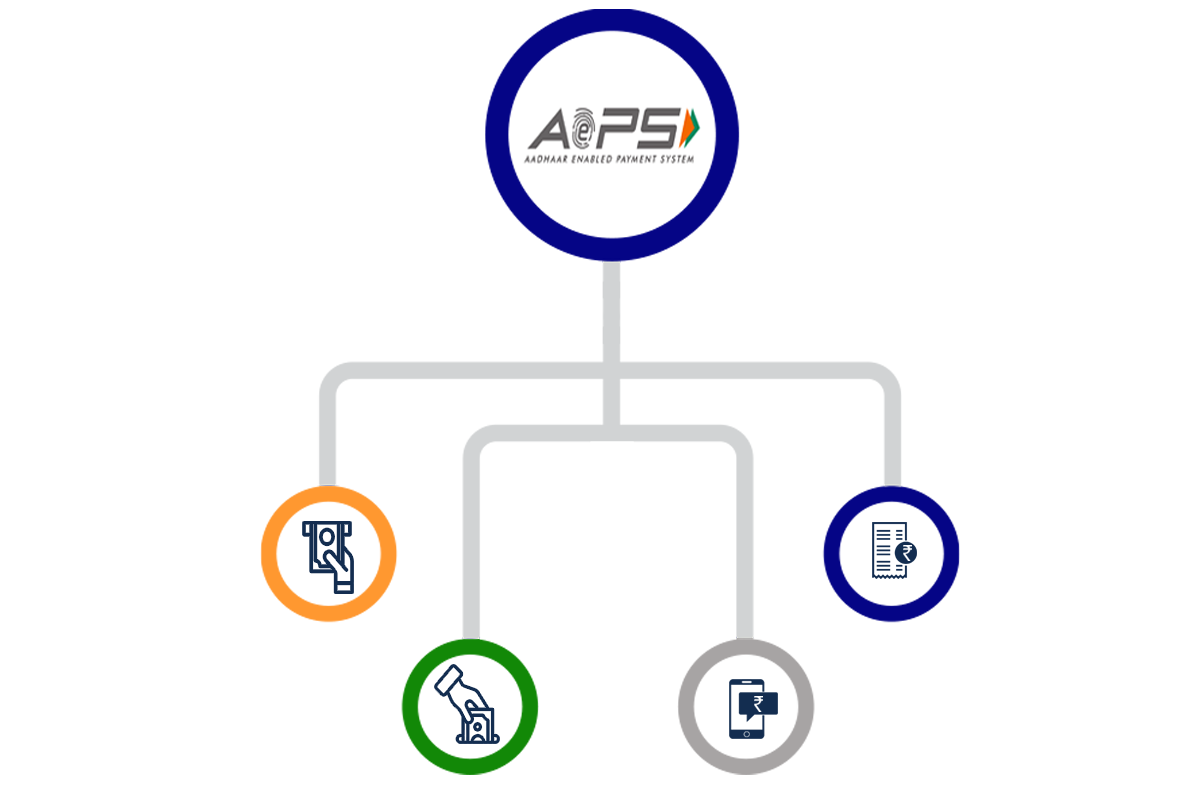

Why go searching for your bank when you have Etailed India Retail touchpoint next door for all your banking needs? Aadhaar Enabled Payment Service (AEPS), uses Aadhaar Data and Biometric authentication instead of signature or debit card information of the customers and allows them to quickly Withdraw, Deposit and Transfer cash & also access bank statements without visiting their bank branch. So, instead of searching for an ATM or a bank branch, customers can visit their nearest Etailed India retail touchpoints and do all of these transactions using their Aadhaar Data and Biometric Authentication.

Instant Service Activation.

Margins Instantly Credited.

Payout Facility on Bank Holidays.

Choose from Variety of Bio-Metric Devices.

Switch between Multiple Banks for AEPS.

Withdrawal Limit between ₹100 - ₹10,000.

Be it Cash Withdrawals or Mini Statements or any other vendor payment requirement, you can avail top-rated AEPS services of Etailed India

AEPS means Aadhaar Enabled Payment System, a new payment service offered by the National Payments Corporation of India to banks and financial institutions using ‘Aadhaar’. Aadhaar is a unique identification number issued by the Unique Identification Authority of India (UIDAI).

An Aadhaar Micro ATM is a payment solution for thousands of

individuals who can do Cash Withdrawal transactions by just using their Debit Card.

Small, handy device, alternative for Cash Withdrawal facility through any bank Debit

Card.

An Aadhaar ATM Machine provides several advantages and beneficial services to

individuals. These services are pointed down below.

An Aadhaar Micro ATM Machine facilitates a secured and safer method of Cash

Withdrawal from Bank Account without visiting Bank Branch or ATM Point.

Purpose:- To Serve the unserved. Augment the public banking services

infrastructure.

What is an AEPS? Customer Fingerprints verification through

Biometric.

How does it work? Agent /Retailers use Etailed India AEPS APP/PW after due

authorisation.

Service Offered:- AEPS Cash Withdrawal & Balance Enquiry and soon launch

Deposit Facility for ICICI Bank Customers.

Withdrawal Limit:- Rs 10,000 per transaction with no daily limit*

Number of Bank Mapped for Scheme:- Service Available from no. 118 banks.

(Covered 99% of Bank Accounts)

Transaction Cost:-

1. NIL to customer

2. Merchant or BC get Commission from Bank as per mutual Agreement

Only 40,000 ATMs in rural districts out of 2,20,000 ATMs

across India.

62% of Indian population resides in Rural Districts.

Only 18% of ATMs are deployed in Rural Geographies.

Public sector banks have deployed 1 out of every 5 ATMs in these geographies and

private sector banks have deployed only 1 out of every 10 ATMs in rural districts.

AEPS stands for Aadhar Enabled Payment Systems and a

dedicated AEPS service provider enables its clients to make their payments safer and

easier by using their Aadhaar cards

Why AEPS – A Big Business Opportunity?

1. India will require at least 2 Crore + Micro-ATMs to match ATM Penetration with

countries like South Africa, China etc.

2. Half of the 2.38 lakh ATM machines are not sufficient to cater our population

across Pan India.

3. Govt pushing all Govt to Citizen benefits directly in Citizen Bank Accounts like

Menraga Wages, Gas Subsidy Etc.

4. Recent Budget Govt Propose to give Rs 6000/- to 14 Crores Framers. First

Instalment of Rs 2000/- will credit in March.

5. Govt Giving Rs 2000 /- Overdraft Facility in 34 Crores Jan Dhan Accounts.

6. Various Pension schemes by State & Central Govt.

7. AEPS stands for empowering millions of commoners and businessmen. Many Government

schemes like Social Security Pension, NREGA Old Age Pension, etc. can also be

performed with so much ease through an AEPS portal.

With an AEPS app, AEPS software or an AEPS portal, in total AEPS means you have the

facility to switch your bank with another bank for the purpose of money transfer.

Transaction Failure Ratio 20-30% in AEPS due to Biometric

Mismatch.

Various Garmin Banks – Aadhaar not Mapped.

North-East States like ASSAM – Aadhaar enrolment is very less.

Retailer can easily convert this business through m-ATM.

AEPS which stands for Aadhaar Enabled Payment System is an

AEPS payment system where the retailers link their Aadhaar Cards to their bank

accounts to enjoy the various benefits and services of AEPS.

AEPS service provider company lists out many benefits as well as it’s eligibility

criteria for agent enrollment.

No paper or card is required while performing AEPS transactions. However, if an

individual fails to link his or her Aadhaar to the bank account, then AEPS service

provider company lists that he/she is not entitled to reap the benefits of AEPS

facilities like AEPS cash withdrawals, money transfers and more. Some of the major

requirements are:

1. Your Aadhaar Number

2. Your Fingerprint

3. Your Name or Bank IIN (Issuer Identification Number)

Thereafter, in order to get your AEPS agent registration free and do money

transactions easily, all you need to remember is your Aadhaar number. Also, you will

be surprised to know that AEPS software is easy to use.

Our team is here to answer your question about Etailed India

Contact Us Or, get started now with a free trial